How to Estimate Your Quarterly Taxes as a Freelancer

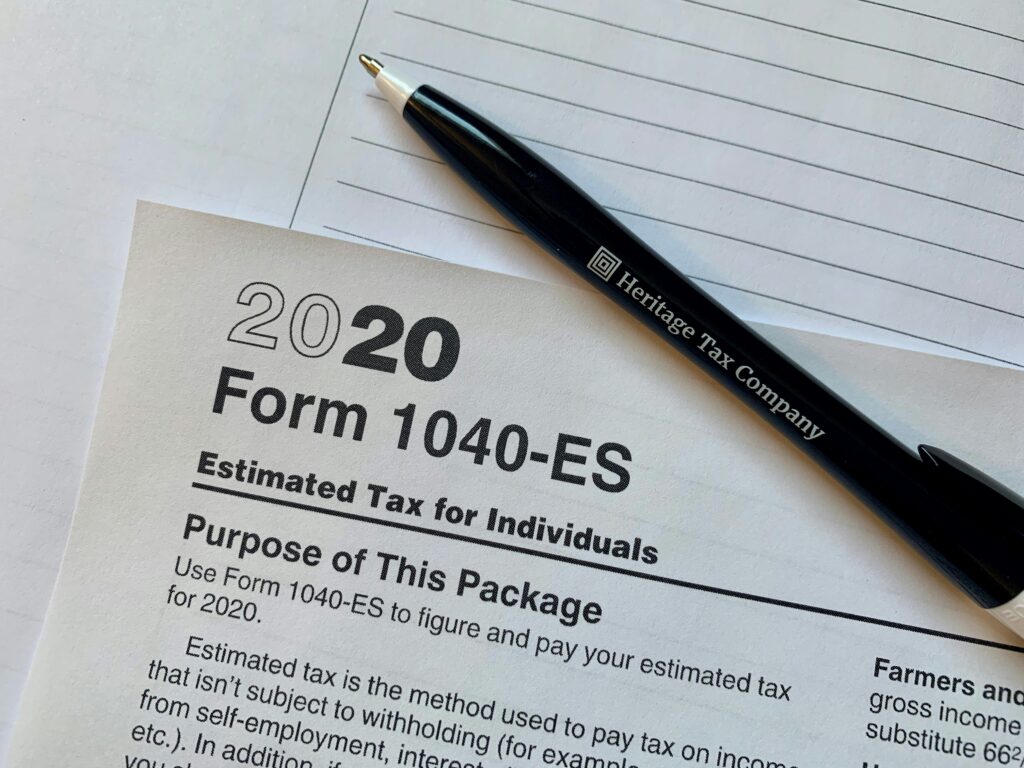

Why Quarterly Taxes Matter Freelancers often operate without the traditional employer tax withholdings, which is why the IRS requires many […]

How to Estimate Your Quarterly Taxes as a Freelancer Read More »