Know Your Deductions

The tax code has its traps but if you know your deductions, you can keep more of what you earn. Start with the home office deduction. If you have a room or defined space you use solely for business, measure it. The IRS allows a deduction based on square footage. Don’t fudge the numbers, but don’t downplay them either.

Next, track all business related equipment, software, and subscriptions. Adobe, Zoom, Notion if it helps you do your job, it might be deductible. Save every receipt, and keep itemized records. When April hits, you’ll be glad you weren’t guessing.

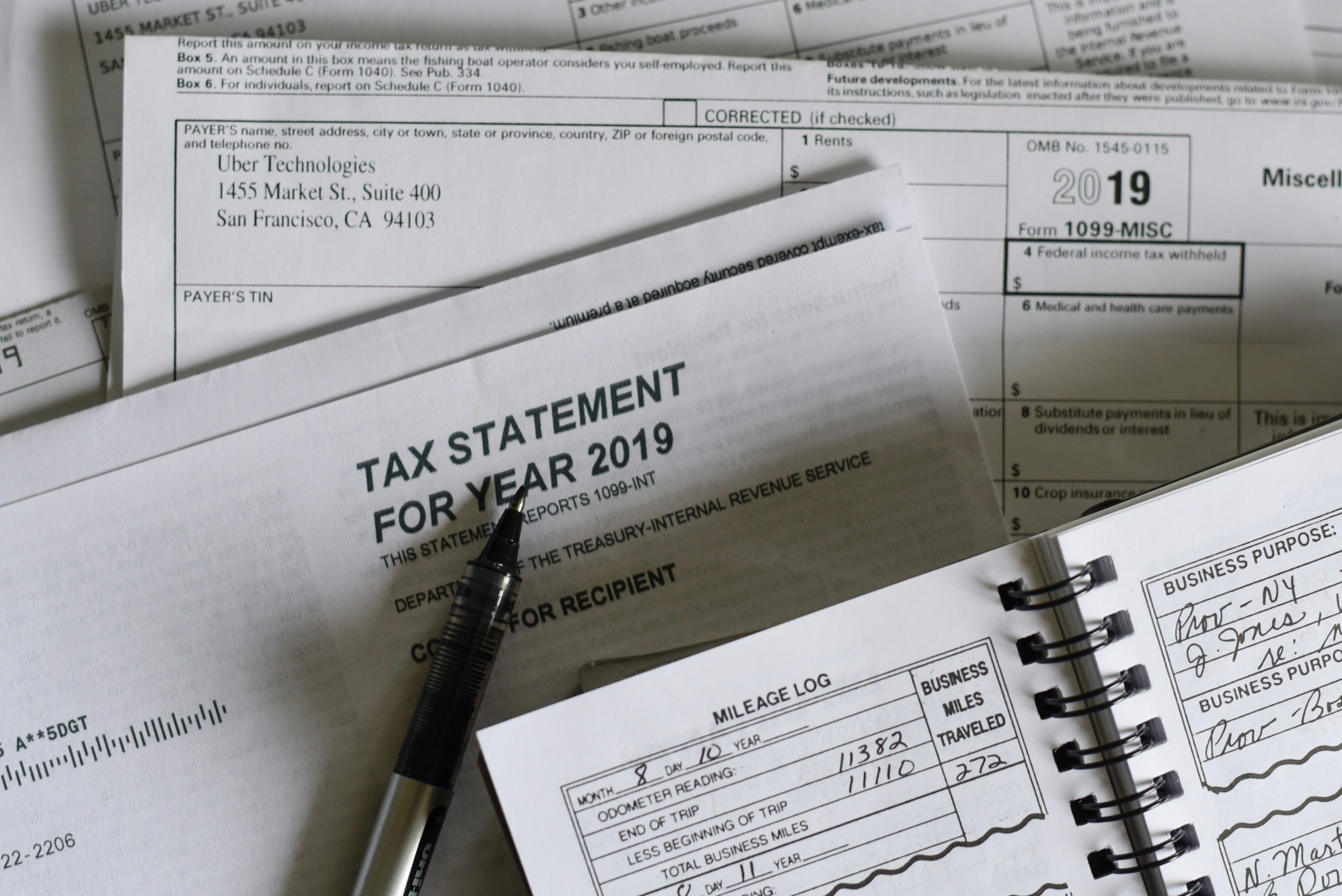

Travel and meals are still on the table but only if they’re work related. That Uber to a client shoot? Good. A “brainstorming brunch” with your roommate? Not so much. Be honest, and have the records to back it up.

Finally, don’t sleep on health insurance premiums and retirement options. If you’re self employed, your monthly premiums may be deductible. And contributing to a SEP IRA or solo 401(k) doesn’t just build your future it slashes your taxable income now.

Check out these finance saving suggestions for more actionable tips.

Track Every Expense

Staying on top of your finances starts with tracking every dollar that moves. Use cloud based accounting tools like QuickBooks, Bonsai, or FreshBooks. They’re not just for number nerds they save time, sync with your bank, and help you stay audit proof. Set one up early in the year, and let automation do the heavy lifting.

Next, get into the habit of scanning receipts as they come in. Waiting until tax season to dig through a year’s worth of crumpled restaurant receipts and half faded gas slips? That’s chaos. Snap, upload, categorize make it a 30 second part of your routine.

Finally, draw a hard line between personal and business finances. Open a separate bank account for your freelance income and expenses. It keeps records clean, simplifies deductions, and protects you if you’re ever audited. Mixing the two is a headache you don’t need.

Quarterly Taxes: Don’t Sleep on Them

Freelancers don’t get W 2s or automatic tax withholding. That means you’re on the hook to pay the IRS every quarter and missing those dates can get expensive. The usual due months are April, June, September, and January, but double check with the IRS each year to stay current.

Use last year’s tax bill as your reference point. If you owed $12,000 last year, you’re looking at $3,000 per quarter. Not exact science, but it gets you in the ballpark. Many freelancers play it safe by putting aside 25 30% of everything they earn. That money’s not yours at least not yet.

Planning isn’t sexy, but penalties sting. If you underpay, the IRS charges interest like a credit card company. Smart freelancers set reminders, automate transfers, and treat tax savings like rent: non negotiable. Stay ahead, and tax season won’t slap you sideways.

Retirement Contributions = Lower Taxable Income

Freelancers often skip retirement planning because it feels optional. It’s not. If you’re self employed, stashing money into a retirement account is one of the most straightforward ways to cut your taxable income and protect your financial future.

Solo 401(k)s and SEP IRAs are two of the best tools in your kit. Both let you make large, tax deductible contributions, and both are flexible depending on how much you earn in a given year. The Solo 401(k) is ideal if you’re a one person show and want to contribute both as employer and employee. The SEP IRA works well if your income fluctuates or you have a few contractors over time. Either way, you’re trimming your taxable income while building real savings.

Then there’s the perennial question: Roth or Traditional IRA? If you’re early in your career or have a lower income this year, a Roth where you pay taxes now and withdraw tax free later might be the smarter move. If you’re pulling in higher income and need to reduce your tax bill today, a Traditional IRA gives you that immediate deduction.

Bottom line: contribute. Skipping this isn’t saving yourself effort it’s setting yourself up for a bigger tax bill now and less security later. Make space for retirement savings in your budget. It’s basic self defense in the freelancer’s financial playbook.

Form an LLC or S Corp If It Makes Sense

Choosing the right business structure isn’t just a legal decision it’s a smart tax move. Whether you’re just starting out or scaling your freelance business, forming an LLC or electing S Corp status can change your tax picture significantly.

Benefits of an LLC

An LLC (Limited Liability Company) offers simplicity with some important protections:

Limited liability: Separates your personal and business finances, protecting your personal assets

Simple setup and maintenance: Less paperwork than corporations

Flexible taxation options: By default taxed as a sole proprietorship, but you may elect S Corp status later if needed

When an S Corp Makes Sense

An S Corporation requires more upkeep but comes with notable tax advantages if you’re earning a healthy freelance income:

Lower self employment taxes: You pay yourself a reasonable salary (subject to payroll taxes), and the rest of the income can pass through as distributions, which aren’t subject to self employment tax

Potential for significant tax savings once you’re consistently netting a solid income (many tax pros suggest it starts to make sense around $75,000 $100,000 in net earnings)

A Word of Caution

More paperwork: S Corps require payroll processing, separate corporate tax filings, and regular compliance

Not a DIY decision: Choosing between an LLC and S Corp and knowing when to elect should be done with a qualified tax professional

A 30 minute consultation with a CPA could save you far more than trial and error learning ever will.

Before making a move, assess your income consistency, administrative capacity, and long term business goals. Not every freelancer needs to form a business entity but for those who do, the tax upside can be substantial.

Leverage Pro Advice Early

Taxes as a freelancer aren’t a side quest they’re core gameplay. A solid CPA who understands the freelance world isn’t just helpful, they’re essential. They know how to spot red flags and find deductions you didn’t know existed. The cost of hiring one often pays for itself through tax savings alone.

Now, if you’re going the DIY route, make sure you’ve got more than a spreadsheet and a hope. Invest in legit tax software something built for self employed income and expense tracking. But even then, this only works if you actually understand what you’re doing. Taking advice from a random Reddit thread or YouTube comment section? Risky move. Misinformation is rampant, and a single bad choice could trigger fines or audits.

Being proactive with professional guidance can save you major stress and a lot of money. More finance saving strategies here to keep even more of what you earn.