Organize Early, File Strategically

Why Filing Early Pays Off

Waiting until the last minute can put your refund and your identity at risk. Filing early not only ensures a faster turnaround from the IRS, but also helps you steer clear of potential fraud. The earlier you file, the less chance identity thieves have to submit a return in your name.

Key benefits of filing early:

Faster refunds

Reduced risk of identity theft

More time to correct errors or gather documentation

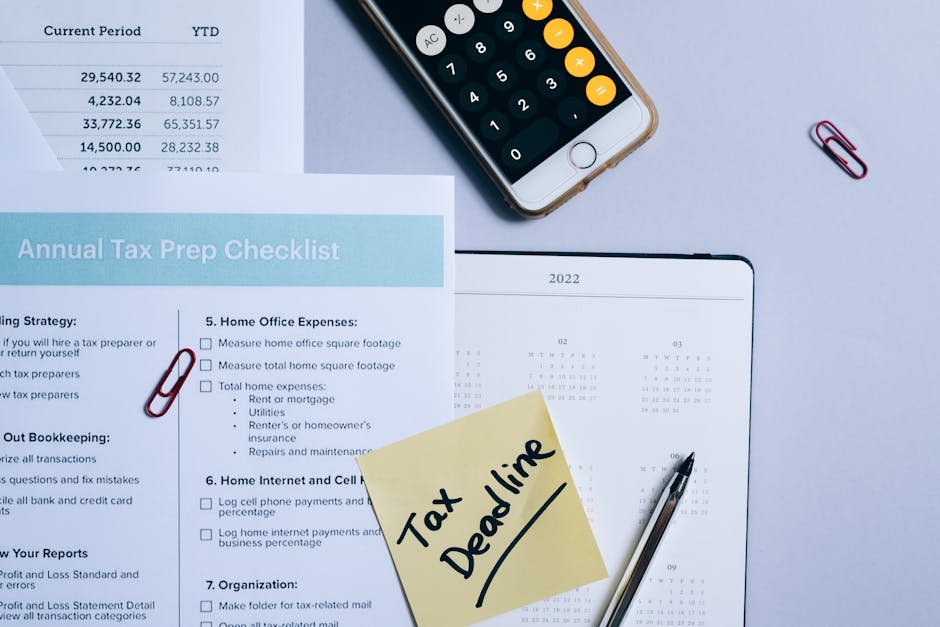

What to Organize Before Filing

Don’t wait until April to start pulling documents together. Begin organizing your financial records as early as possible ideally by February. That way, you’re not scrambling under pressure.

Check off the essentials:

W 2s and 1099s from all sources of income

Receipts for deductible expenses, such as medical bills, charitable donations, and job related costs

Interest and dividend statements

Mortgage interest and property tax records

Proof of IRA or HSA contributions

Any additional forms specific to your tax situation

When to Get Professional Help

If your financial situation is even slightly complex, navigating forms and deductions can get tricky fast. In that case:

Use a reputable tax software program with live support

Or, better yet, hire a certified tax professional to review your options and maximize your return

Getting a head start won’t just save time it could mean saving (or earning) hundreds or even thousands of dollars.

Max Out Contributions to Tax Advantaged Accounts

Got some extra cash and an eye on a bigger refund? You’ve still got time. Contributions to your IRA or HSA for the 2025 tax year are allowed up until the April 2026 filing deadline. That’s a solid extension and a smart opportunity for last minute tax planning.

Traditional IRA contributions can lower your taxable income, and if you qualify, they might also unlock other deductions or credits. HSAs, meanwhile, are triple tax advantaged: deductible going in, tax free growth, and tax free withdrawals for qualified medical expenses. Few tools pack that kind of punch.

If you’re eligible and haven’t maxed out, this is your window. Don’t leave money (or savings) on the table.

Tax credits are a straight shot to lowering what you owe and in some cases, even scoring a refund when you technically didn’t pay that much tax in the first place. But you’ve got to meet the right conditions.

Start with the Earned Income Tax Credit (EITC). It’s aimed at low to moderate income workers and families, and the payout can be surprisingly generous. Maximum credits fluctuate depending on income, filing status, and number of kids but qualifying could mean thousands back in your pocket. Don’t skip it just because your income crept up; the thresholds shift each year.

Next up, the Child Tax Credit. If you’ve got dependent kids under 17, you might be in line for up to $2,000 per child possibly more under future updates. There’s a phase out at higher income levels, so be sure you’re checking that eligibility sweet spot.

Then there are the education credits: the American Opportunity Credit for undergrad students (up to $2,500 per eligible student) and the more flexible Lifetime Learning Credit (up to $2,000 per return, even for part time classes or grad school). If you paid qualified tuition even with loans you could qualify.

Bottom line: these aren’t just deductions. They reduce your actual tax bill, dollar for dollar. Know what you qualify for before you file, and don’t leave money on the table.

Deduct, Then Deduct Some More

Tax season is no time to leave money on the table. The IRS offers a range of deductions you might qualify for if you know what to look for. Student loan interest? Deductible, even if you’re not itemizing. Hunting for jobs in your current field? Those expenses can count, but only if you itemize. Same goes for state and local taxes, which are capped but still matter.

Self employed? Your home office, internet use, and even a portion of your utilities may qualify as business expenses. Just stay honest and keep detailed records.

The key is knowing when itemizing beats the standard deduction. For many, it won’t. But if your deductible expenses add up, choosing to itemize could shrink your tax bill and boost your refund. Run the numbers, or better yet, use software that does it all for you.

Report Side Income and Keep Those Receipts

Freelance gigs, rideshare driving, selling on Etsy it all counts as self employment in the eyes of the IRS. That means you’re on the hook for both income and self employment taxes, and no one’s withholding it for you.

The smart move? Treat it like a real business. Save digital and physical receipts. Track mileage, office supplies, software subscriptions whatever directly supports earning that extra income. Use a spreadsheet or a real bookkeeping app. It’s not glamorous, but come tax time, it pays off.

Also, don’t wait until April to think about taxes. If you’re pulling in steady side income, you may need to make quarterly tax payments to avoid penalties. Learn the system and build it into your routine.

Essential read: How to Strategically Plan for Quarterly Tax Payments

Double Check Filing Status and Dependents

Your filing status isn’t just a box to check it drives your tax bracket, deductions, and refund size. Yet every season, people get this wrong. The most common misstep? Choosing ‘single’ when you qualify for ‘head of household’ or forgetting you can file jointly if you’re married. Head of household gives you better tax rates than single, but you need to meet the criteria, like covering more than half the costs of keeping up a home for a qualified person.

Dependents are another minefield. Many filers wrongly assume they can only claim their kids. Not true. Aging parents, relatives who live with you, even sometimes adult children returning home they might qualify. You just need to meet the IRS dependency rules, and yes, those rules are packed with fine print. But get this part right, and your tax result changes usually in your favor.

This is one of those details that’s easy to gloss over, but it can make or break your return. So take the extra five minutes. It’s worth it.

Consider a Refund Adjustment (W 4 Check In)

Big refund every April? It might feel like a bonus, but it’s really just the IRS giving back your own money interest free. If that sounds familiar, you’re probably over withholding from your paycheck.

Instead of letting a chunk of your earnings sit with the government all year, consider adjusting your W 4 at the start of 2026. The goal isn’t to eliminate your refund entirely, but to tighten the gap so you’re not handing over more than needed. That extra cash could go toward bills, savings, or investments every paycheck.

It’s a small move with a real impact. Download a fresh W 4, run a quick calculator, and make the numbers work harder for you. Tax season shouldn’t be the only time you get a financial win.